The Trusted Tax Strategist & Fractional CFO For Your Medical Practice

Attention: Self-Employed Physicians & Private Practice Owners Earning $500K – $5M Per Year

Discover How to Add $50K – $250K in After-Tax Profit to Your Practice – Without Seeing More Patients or Working Longer Hours

We start by uncovering at least $25K in legal tax savings for physicians earning $500K – $5M… then we turn that win into a complete profit, cash flow, and tax strategy for your practice.

“Because you deserve to keep more of what you earn.”

(No cost. No pressure. Just clarity and insight.)

Watch This 5-Minute Video to See How We Help Physicians Legally Reduce Their Tax Bill by $25K+ in Just 10 Days

Get a Written Plan to Save $25K+ in Taxes, Stop Losing Money, and Start Paying Yourself More

For self-employed physicians earning $500K–$5M, this complimentary session uncovers $25K+ in potential tax savings and outlines your most valuable next steps. If you move forward, we’ll deliver a written plan within 10 days.

(No cost. No pressure. Just clarity and insight.)

Want to see how much you’re overpaying the IRS?

What You'll Get In Your Free Tax Strategy Analysis Session

During your 1-on-1 strategy session, we will:

Analyze your current tax structure to uncover hidden inefficiencies

Identify $25K+ in missed tax-saving opportunities

Pinpoint where your practice is leaking cash or profits

Show you how to increase your take-home pay without seeing more patients

There's no cost and no obligation.

Best case? We uncover $25K – $250K+ in savings and missed profit.

Worst case? You walk away with clarity on your finances, a simple action plan, and concrete next steps to cut your tax bill and increase profit – even if you never hire us.

(No cost. No pressure. Just clarity and insight.)

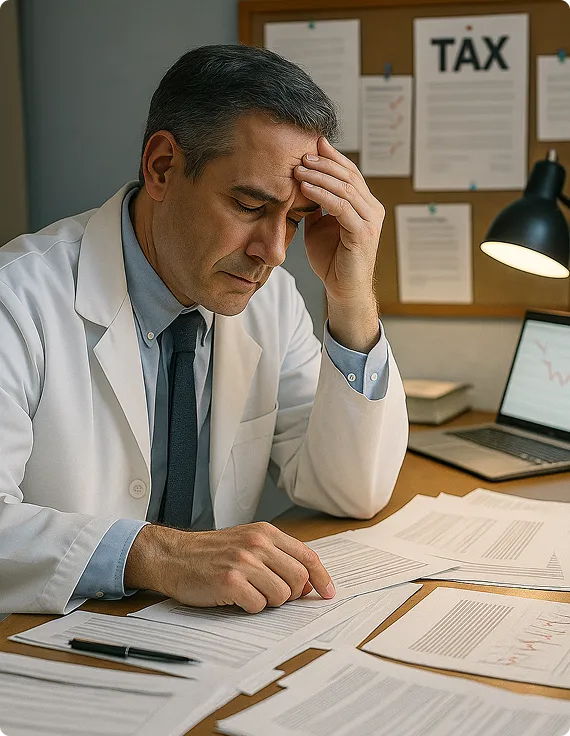

Why Are High-Earning Physicians Overpaying the IRS?

Most successful physicians are losing $25K – $100K+ to the IRS every year – without even realizing it.

You’re Writing Massive Checks to the IRS

You’re paying your fair share – and then some. The average physician pays over $75,000 in taxes annually. We regularly uncover $25K – $100K+ in legal tax savings.

You’re Tired of Last-Minute Tax Surprises

Tax season always feels rushed. You’re reacting instead of planning – and missing out on major deductions and savings strategies.

Your CPA Just Files and Forgets

Most CPAs focus on filing. They don’t build proactive, year-round strategies – and that’s costing you money.

High-Stakes Decisions, No Guidance

You’re making big decisions – hiring, expansions, investments – without the financial visibility or guidance to do it confidently.

Your Cash Flow Feels Unpredictable

Even profitable practices feel tight. Reimbursements are delayed. Overhead is rising. And there’s no system behind your numbers.

Growing Overhead Costs

Your overhead keeps climbing – staffing, EMR, malpractice – and you don't know how to control it.

You don’t need more patients. You need a better financial strategy.

(No cost. No pressure. Just clarity and insight.)

Here’s how we help you solve that – fast.

Introducing: The Practice Profit System™ – Your 3-Step Financial Transformation

More than bookkeeping. More than tax prep. Real financial transformation.

We start with one clear goal: uncovering at least $25K in tax savings fast.

Once we’ve secured those savings, we use them as the foundation for a comprehensive plan to maximize profit, strengthen cash flow, and reduce your tax burden year after year.

Led by Carla Brown, EA, our fully managed service functions as your outsourced financial department – bringing together proactive tax planning, financial management, and CFO-level strategy in one integrated solution for physicians earning $500K–$5M per year.

From there, we implement your plan for you and provide the right level of reporting and advisory for your tier – quarterly sessions for Tax Strategy, monthly financial reporting for Financial Management, and monthly CFO strategy sessions for Strategic CFO – to ensure your strategy continues to deliver.

That way you can focus on patients while we make sure you keep more of what you earn.

(No cost. No pressure. Just clarity and insight.)

We don't just give you a plan. We implement it for you.

When you enroll, we get to work immediately by:

Conducting a complete financial and tax diagnostic

We review your entity structure, prior tax returns, collections process, and overhead to identify missed savings and hidden inefficiencies that could be costing you $25K – $100K+ each year.

Building a custom dashboard with real-time profit and cash flow visibility

You’ll see exactly where your money is going, where profit is being lost, and how much you’re keeping after taxes – all in one clear, easy-to-use view.

Providing ongoing guidance tailored to your practice needs

This ensures your tax plan, profit strategy, and cash flow improvements stay on track and continue delivering measurable results, whether through quarterly advisory sessions, monthly financial reporting, or monthly CFO strategy meetings.

Replacing your reactive CPA with a proactive tax advisory team

We manage your tax strategy year-round, ensuring every decision you make is aligned with your long-term goal of keeping more of what you earn.

Installing a proven system to minimize taxes legally and efficiently year after year

This isn’t a one-time savings. We create a repeatable, compliant process designed to protect your income and optimize your financial results over the long term.

(No cost. No pressure. Just clarity and insight.)

Our Proven Framework Starts With $25K+ in Tax Savings and Builds to $50K – $250K in After-Tax Profit in 12 Months

Our Practice Profit System™ is a proven three-step process that helps physician-owned practices reduce taxes, increase profit, and improve cash flow – all without adding patients or extra hours to your schedule.

Here’s how it works:

Step 1

Step 1: Minimize Taxes

We start by uncovering at least $25K in missed tax savings within 10 days. This includes reviewing your entity setup, income structure, retirement planning, and depreciation strategies to legally and permanently reduce your tax bill.

Step 2

Step 2: Increase Profitability

Once tax savings are secured, we plug revenue leaks, cut unnecessary overhead, and fix inefficient billing processes – so you keep more of what you earn without adding patients or working longer hours.

Step 3

Step 3: Accelerate Cash Flow

With taxes and profitability optimized, we streamline collections, reduce payment delays, and align billing cycles so cash comes in faster and more predictably – giving you the liquidity to cover expenses, fund growth, and reduce stress.

Whether you need essential tax advisory, financial management, or full-scale CFO-level guidance, the Practice Profit System™ has a service tier designed for your stage of practice:

Tax Strategy – Proactive tax advisory and hands-on implementation to capture savings and keep more of what you earn year after year.

Financial Management – Accounting, monthly reporting, forecasting, and scenario planning to give you clarity, control, and decision-ready numbers.

Strategic CFO – Monthly CFO leadership with forecasting, KPIs, and budgeting to guide complex practices and maximize long-term wealth.

No matter which tier you choose, you get more than advice – you get an expert team that implements your plan, manages your strategy, and drives measurable results month after month.

(No cost. No pressure. Just clarity and insight.)

When physicians implement our system, here's what they experience...

How Physicians Transform Their Practices With Us

These are the high-impact financial breakthroughs our clients experience after just a few months of working with us.

Clear Financial Visibility

For the first time, see exactly where every dollar goes in your practice. Our custom dashboards reveal hidden inefficiencies and profit opportunities that most physicians miss. This foundation of clarity eliminates the guesswork that plagues practice management decisions.

Data-Driven Decision Making

With accurate financial insights, practice growth becomes strategic rather than speculative. Whether considering a new physician hire, equipment purchase, or location expansion, you'll have precise projections showing the real impact on your bottom line before you commit.

A New Approach to Taxes

Beyond just compliance, we implement year-round tax strategies tailored to your specific practice. Our physician clients typically identify substantial savings through entity structuring, retirement planning, and timing strategies that traditional accountants often miss until it's too late.

Reduced Financial Stress

As you gain control over your practice finances, the constant worry about unexpected tax bills, cash flow crunches, and uncertain profitability dissolves. Our physicians report this newfound confidence extends well beyond their practice – improving their overall quality of life.

Pathway to Personal Wealth

With optimized practice finances, we help direct your increased profitability toward building lasting personal wealth. Your practice becomes not just a source of income, but a strategic asset in your comprehensive wealth-building plan designed specifically for medical professionals.

More Time for What Matters

Perhaps most valuable of all, our comprehensive financial management frees you from the 8–12 hours physicians typically spend each month on financial matters. This reclaimed time returns to what truly matters – your patients, your continued education, or simply more time with family.

(No cost. No pressure. Just clarity and insight.)

We offer three service levels to match your practice's specific needs...

Customized Financial Support for Every Stage of Your Medical Practice

All tiers include responsive, unlimited access to our expert team – what changes is the depth, strategy, and hands-on implementation.

Tax Strategy

Ongoing Tax Advisory & Implementation

Take the Proactive Tax Plan you’ve invested in and make sure the strategies are implemented, monitored, and updated year-round so your savings are actually realized.

White-glove coordination and oversight of your tax plan implementation through proactive guidance and seamless collaboration with your financial, legal, and insurance professionals to ensure every strategy is executed precisely and aligned with your overall financial goals

Quarterly tax advisory sessions to monitor savings, adjust strategies, and ensure your plan evolves with your practice

Mid-year tax projection & estimated payment guidance so you avoid IRS penalties and eliminate year-end surprises

Annual tax return preparation & filing that fully integrates your proactive tax strategies with built-in compliance safeguards

IRS audit support & documentation guidance to reduce stress and ensure you’re fully prepared if audited

Unlimited email support + office hours access for timely answers when decisions can’t wait

Best for: Physicians and practice owners who want to ensure their Proactive Tax Plan doesn’t sit on a shelf, but is executed properly and adapted as their practice evolves.

(No cost. No pressure. Just clarity and insight.)

Financial Management

Accounting & reporting

Expand beyond tax savings by adding full outsourced accounting, reporting, and financial management so you always know exactly where your practice stands.

Everything in the Tax Strategy tier, plus:

Monthly accounting & reconciliations to keep your numbers accurate, timely, and audit-ready

Monthly financial statements (P&L, balance sheet, cash flow) with plain-English insights you can act on

Active oversight of accounts receivable & payable to accelerate collections, streamline disbursements, and maintain predictable cash flow

Cash flow forecasting & reserve planning to ensure payroll, taxes, and investments are always covered

Strategic scenario planning for major decisions (staffing, equipment, expansion) with modeled after-tax outcomes

Priority response for urgent finance and tax questions

Best for: Practice owners who want proactive tax savings and clean, timely numbers they can trust to guide daily decisions.

(No cost. No pressure. Just clarity and insight.)

Strategic CFO

financial Leadership

Step into a CFO-level partnership where every major business and financial decision is guided by strategy, data, and tax efficiency.

Everything in the Financial Management tier, plus:

Monthly CFO strategy sessions to guide high-stakes decisions and long-term planning

Advanced forecasting & financial modeling to evaluate expansions, payer mix shifts, or staffing changes

Custom KPI dashboards & performance reviews for providers, locations, and service lines

Budgeting & compensation planning to maximize take-home pay and retain top providers

Capital allocation & banking advisory to optimize liquidity, financing, and growth investments

Practice valuation insights & growth planning to increase equity value and prepare for future exit or transition

Best for: Multi-provider or multi-location practices ($1M–$5M+) ready to delegate financial leadership entirely and scale with confidence.

(No cost. No pressure. Just clarity and insight.)

(No cost. No pressure. Just clarity and insight.)

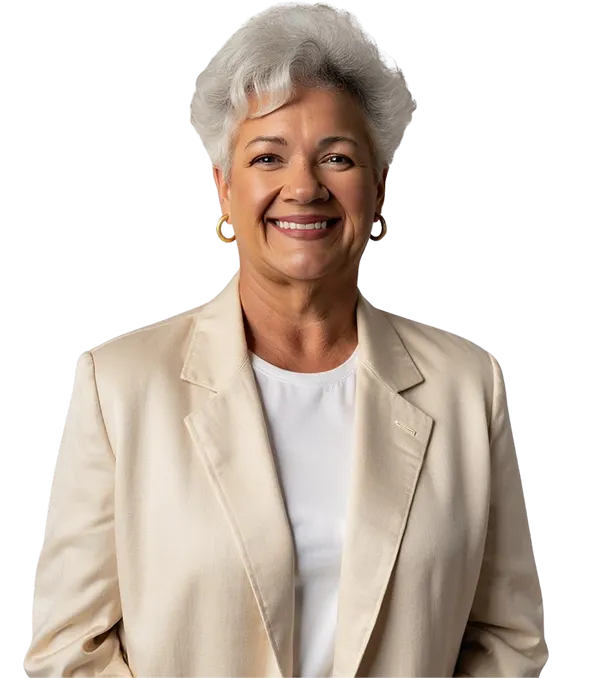

The expert behind this proven system is Carla Brown, EA...

Meet Your Trusted Advisor

Carla Brown, EA

Carla Brown is a federally licensed Enrolled Agent – the highest credential awarded by the IRS, with the same legal standing as CPAs and tax attorneys to represent clients in all tax matters nationwide.

For over a decade, she’s served physician-owned practices as the trusted advisor they turn to when basic bookkeeping and tax prep aren’t enough, combining deep tax expertise with strategic business insight to eliminate financial guesswork and improve profitability.

Her connection to physicians is also personal. Both of her sons, Ben and Alex, were born with hip dysplasia and underwent double hip replacements, and her daughter Emily is an ICU nurse.

The care her family received from physicians inspired her to create the Practice Profit System™ – a way to give back by helping doctors navigate complex financial decisions with confidence.

Today, Carla helps physicians reduce surprise tax bills, increase take-home pay, and build long-term wealth, turning their practices into powerful engines for financial security and peace of mind.

(No cost. No pressure. Just clarity and insight.)

Here’s how we make your financial transformation simple and stress-free...

Start Your Financial Transformation in Just 3 Simple Steps

Step 1

Your Free Strategy Session

We’ll review your current structure, uncover $25K+ in potential tax savings, and show you exactly where profit is being lost. A real conversation with clear, actionable insight.

Step 2

Your After-Tax Profit Plan

Within 10 days, you’ll receive a written plan that quantifies your tax savings, outlines profit opportunities, and gives you a clear path to increasing take-home pay and building long-term wealth.

Step 3

Implementation & Ongoing Support

We put the plan into action and continue managing it for you – from quarterly tax advisory to monthly reporting or CFO strategy sessions depending on your tier – so your results keep growing while you stay focused on patients.

(No cost. No pressure. Just clarity and insight.)

30-Day Money-Back Guarantee

We Stand Behind Our Work – So You Can Move Forward Without Worry

We know the value of our complimentary Tax Strategy Analysis session and the results that come from working with us – and we want you to feel completely confident as you get started.

That’s why we offer a 30-Day, No-Risk, Money-Back Guarantee on all service tiers (Tax Strategy, Financial Management, and Strategic CFO).

If you move forward with any tier and decide it’s not the right fit within the first 30 days, just let us know – we’ll refund you in full. No fine print. No questions asked.

We offer this guarantee to give you complete confidence. Most firms would never offer this. We do – because we stand behind our work, and because physicians deserve this level of trust.

(No cost. No pressure. Just clarity and insight.)

Frequently Asked Questions About the Practice Profit System™

Common questions physicians ask before starting their financial transformation

Q: How quickly will I see results?

A: Many physicians start seeing financial clarity within 2–4 weeks, and identify their first major tax-saving opportunity within 30 days. Cash flow gains and compensation increases often follow in the next 60–90 days. The full $50K–$250K in annual profit improvement typically unfolds over 6–12 months.

Q: How much time will this require from me?

A: Not much. Beyond your initial consultation, most clients spend just 1–2 hours per quarter on strategy calls in the Tax Strategy and Financial Management tiers, and 1–2 hours per month in the Strategic CFO tier. We handle the rest. In fact, many clients gain time by handing off tasks they were managing alone.

Q: How is this different from my current CPA?

A: Most CPAs focus on tax filing. We focus on financial transformation. We combine tax strategy, accounting, and CFO insight under one roof – and tailor it exclusively to the financial realities of physicians.

Q: What If I already use accounting software?

A: Great – we integrate with most platforms like QuickBooks or Xero. But software is only as good as the strategy behind it. We turn your financial data into a plan – then we execute that plan for you.

Q: Do you work with my specialty?

A: Most likely. We've worked with physicians in family medicine, pediatrics, dermatology, orthopedics, internal medicine, plastic surgery, psychiatry, and more. We know the nuances of different specialties – and how to optimize finances in all of them.

Q: Is my practice too small (or too large) for your service?

A: We serve solo physicians all the way up to multi-location groups with dozens of providers. Our tiered model grows with you, offering essential support early on and strategic insight as you scale.

(No cost. No pressure. Just clarity and insight.)

Address

Brown Tax & Accounting LLC

206 East Main Street

Portageville, Missouri

Phone: (573) 379-3826